Foreign investors establishing businesses in Vietnam all aim for their business activities to be sustainable and steadily developed. However, due to various objective or subjective reasons, investors may find themselves unable to continue operations. In such cases, if investors wish to terminate their business activities in Vietnam, they must undergo the procedure for dissolving the enterprise.

To complete the dissolution procedure, foreign investors need to navigate through various complex administrative procedures. Understanding these needs, OTIS LAWYERS is ready to support investors with efficient and cost-effective enterprise dissolution services.

CASES AND CONDITIONS FOR ENTERPRISE DISSOLUTION

Cases of enterprise dissolution

Enterprises may be dissolved under the following circumstances: (Based on Article 207, Law on Enterprises 2020)

(a) Expiry of the operation term as stated in the company’s charter without extension;

(b) Resolution or decision of the business owner for private enterprises; Board of members for partnerships; Board of members/Owner for limited liability companies; General Meeting of Shareholders for joint stock companies;

(c) The company does not have the minimum number of members as required by the Law on Enterprises for six consecutive months without undergoing the conversion procedure;

(d) Revocation of the enterprise registration certificate, except as provided by the Tax Management Law.

Conditions for enterprise dissolution

An enterprise can only be dissolved if it meets the following conditions:

Ensure full payment of all debts and other property obligations;

The enterprise is not in the process of settling disputes in court or arbitration.

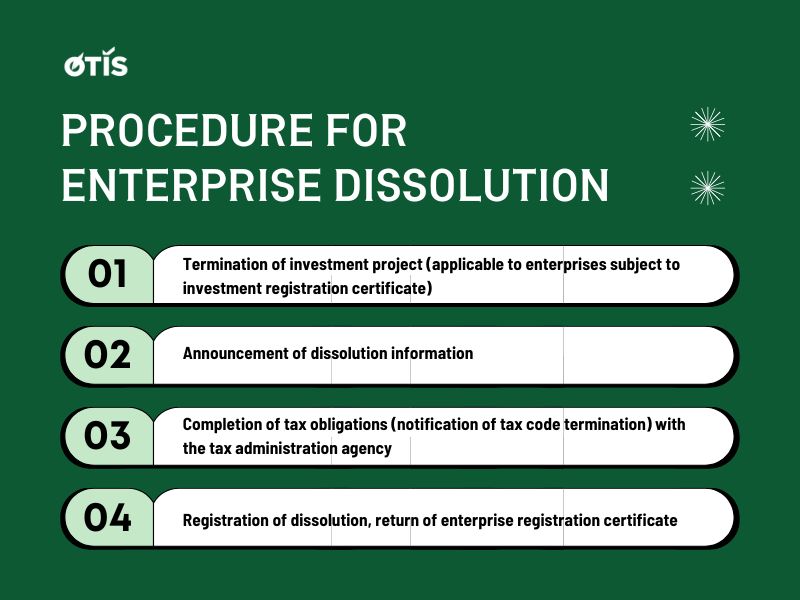

PROCEDURE FOR ENTERPRISE DISSOLUTION

Step 1: Termination of investment project (applicable to enterprises subject to investment registration certificate)

Within 15 days from the date of the decision, investors prepare and submit documents to the Investment Registration Authority, including:

- Decision of the owner on termination of the investment project;

- Notification of termination of the investment project;

- Investment registration certificate;

- Power of attorney (if any).

Step 2: Announcement of dissolution information

Within 7 working days from the date of approval, the dissolution decision and minutes of the meeting must be sent to:

- Business registration authority;

- Tax authority;

- Employees of the enterprise.

And publish the dissolution decision on the National Business Registration Portal and publicly post it at the headquarters, branches, and representative offices of the enterprise.

Step 3: Completion of tax obligations (notification of tax code termination) with the tax administration agency

Documents include:

- Confirmation of tax obligations completed for import-export activities by the General Department of Customs if the enterprise engages in import-export activities;

- Request for tax settlement;

- Request for confirmation of tax obligations completed;

- Notice of enterprise dissolution;

- Notice of dissolution announcement;

- Decision to dissolve the enterprise;

- Power of attorney (if any).

Processing time: Approximately 45 working days from the date of submitting complete documents.

Step 4: Registration of dissolution, return of enterprise registration certificate

Documents include:

- Notice of enterprise dissolution;

- Asset liquidation report of the enterprise;

- List of creditors and settled debts including tax debts and social insurance debts (if any);

- List of employees after the enterprise dissolution decision;

- Seal and seal specimen certificate (if any);

- Enterprise registration certificate;

- Power of attorney (if any).

Authority to process: Business registration authority.

Processing time: Approximately 180 days from the date of receiving the dissolution decision at Step 2.

Note: If the enterprise was established before July 1, 2015, and uses a seal issued by the police, it must return the seal to the police. For enterprises established after this date that manage their own seals, this procedure is not required.

For any questions or comments, please contact:

OTIS AND PARTNERS LAW FIRM

Office address: 2nd Floor, CT3 Building, Yen Hoa Park View Urban Area, No. 3 Vu Pham Ham Street, Yen Hoa Ward, Cau Giay District, Hanoi

Email: info@otislawyers.vn

Hotline: 0987748111

Tiếng Việt

Tiếng Việt 한국어

한국어 中文 (中国)

中文 (中国)